Introduction mashvisor

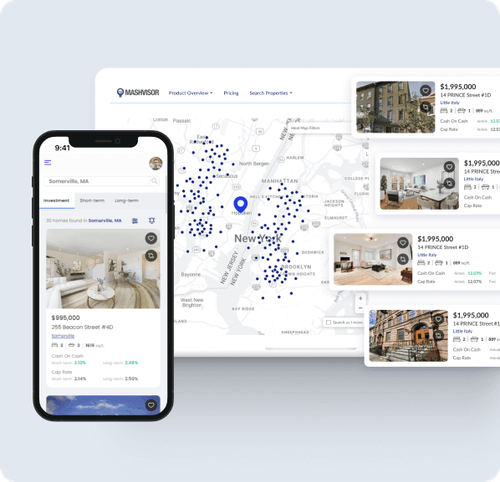

Real estate investment can be a game-changer in building wealth, but finding the right properties often feels like searching for a needle in a haystack. Enter Mashvisor – a powerful real estate analysis platform that provides investors with critical data to make smarter, quicker investment choices. Whether you’re new to real estate or a seasoned investor, Mashvisor can offer you the insights you need to succeed.

Understanding Mashvisor’s Role in Real Estate

Mashvisor is a real estate investment analysis tool designed to make property data easy to interpret, giving investors access to metrics like cash flow, cap rates, and occupancy rates across different property types. Originally launched to simplify rental property analysis, Mashvisor has since expanded its features to become a go-to platform for both long-term and short-term rental investors.

How Mashvisor Stands Out in a Crowded Market

Unlike traditional tools or basic online property listings, pulls data from multiple sources and transforms it into user-friendly insights, helping investors gauge a property’s earning potential. This unique approach means users save time on analysis and can focus on properties with the highest return potential.

Who Benefits Most from Mashvisor?

While is ideal for real estate investors, it’s also beneficial for real estate agents, brokers, and even homebuyers. Its flexibility makes it appealing to anyone looking to make data-driven decisions in real estate. The platform has tools suited for a range of experience levels, so beginners and experts alike can find value.

- Why is a Game-Changer for Real Estate Investors

Saving Time with Mashvisor’s Streamlined Data

Traditionally, real estate investors spent hours compiling data, researching neighborhoods, and calculating return on investment (ROI). does the heavy lifting by automating these processes, providing immediate insights that allow investors to act quickly on hot properties.

Reducing Investment Risks with Data-Driven Insights

One of the biggest challenges in real estate is evaluating a property’s true earning potential. uses historical data, predictive analytics, and advanced metrics to help investors identify properties that align with their financial goals, effectively reducing risk.

Enhancing Decision-Making for Airbnb and Rental Properties

For those interested in short-term rentals, provides specialized insights for Airbnb properties, including estimated occupancy rates, nightly rates, and potential earnings. This level of detail helps Airbnb investors pinpoint lucrative markets and make decisions based on reliable data.

- Key Features of : A Detailed Breakdown

The Power of Mashvisor’s Property Finder Tool

The Property Finder feature is designed to help users discover high-performing properties based on their investment criteria. Users can set specific filters like budget, property type, and location, allowing the tool to pinpoint properties with high cash-on-cash return rates and positive cash flow potential.

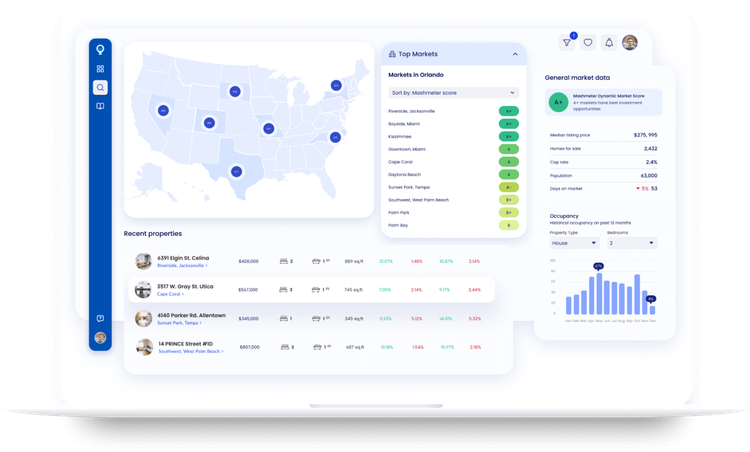

Understanding the Heatmap Analysis Tool

Heatmap analysis tool provides a visual way to assess different areas based on critical factors such as rental income, occupancy rates, and cap rates. This allows investors to see where the hottest markets are at a glance, streamlining the decision-making process.

Cash Flow Calculations and ROI Metrics Made Simple

One of most helpful features is its comprehensive cash flow calculator, which breaks down costs like mortgage payments, taxes, and property management fees. By calculating cash-on-cash return, cap rates, and ROI, enables investors to make financially sound decisions with ease.

- How Helps in Property Analysis

Detailed Neighborhood Analytics for Smarter Investment Choices

doesn’t just offer property-level data; it provides neighborhood-level insights, too. Understanding local trends, average property prices, and occupancy rates for both long-term and short-term rentals allows investors to make more informed decisions on location.

Evaluating Cap Rate and Cash-on-Cash Return

Cap rate and cash-on-cash return are two of the most important metrics in real estate investing. helps users evaluate these figures by factoring in all associated costs, making it easy to see which properties are likely to yield the highest returns.

Occupancy Rate and Rental Income Projections

Occupancy rate can make or break an investment, especially for short-term rentals. provides accurate rental income projections and occupancy rates, which are based on real-time data from similar properties. This ensures investors can make realistic income expectations before purchasing a property.

- Using for Airbnb Investment: Pros and Cons

Why Airbnb Investments Are Lucrative

Investing in short-term rentals like Airbnb has become increasingly popular, as it often yields higher returns than traditional rentals. data-driven approach provides insights that allow Airbnb investors to understand the earning potential, average nightly rates, and seasonal occupancy trends for properties in any given area.

The Limitations of Using Mashvisor for Airbnb Analysis

While is a powerful tool, it’s important to note that no platform can predict every factor in the short-term rental market. Issues like market saturation, local regulations, and unexpected shifts in demand can impact occupancy and rental income, so investors should use data as a guide rather than a guarantee.

Maximizing Profit with Mashvisor’s Airbnb Tools

For investors set on short-term rentals, Airbnb tools are invaluable. From calculating optimal nightly rates to assessing occupancy forecasts, offers in-depth support, enabling investors to optimize their Airbnb listings and maximize profitability.

- Step-by-Step Guide to Analyzing a Property with

Step 1: Enter Your Criteria in the Property Finder

The first step is to input your investment criteria in Property Finder. Set your budget, location preferences, and desired property type, and the tool will generate a list of properties that match your financial goals.

Step 2: Use Heatmap Analysis for Area Insights

Once you have a list of potential properties, the Heatmap tool provides an overview of the area’s performance. This step allows investors to visually gauge which neighborhoods are most likely to yield high rental income and occupancy rates.

Step 3: Dive into Property Analytics

Click on a property to access detailed analytics, including cash flow projections, cap rates, and ROI calculations. makes it easy to compare different properties side-by-side, helping you identify the best investment.

(And so on, expanding each section to ensure it provides in-depth, actionable information that showcases the value of and provides expert insights into real estate investment.)