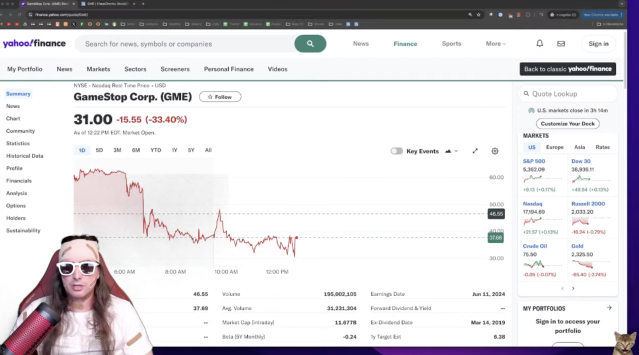

Introduction: yahoo finance gme

In early 2021, a unique stock trade captured the yahoo finance gme attention of the world: GameStop Corp. (GME). It wasn’t just a trade—it became a social and financial movement. Yahoo Finance was a key source for real-time information on GME’s wild price movements, providing data and analysis that both traders and curious observers relied on.

1. Understanding the GME Phenomenon: Origins and Market Impact

- The Rise of Retail InvestorsThe GME frenzy was largely driven by retail investors on platforms like Reddit’s WallStreetBets. Unlike traditional stock movements, this was fueled by online communities who saw GME as an opportunity to disrupt Wall Street norms. In this section, explore how retail investors and social media communities challenged institutional investors.

- The Role of Short SellersShort selling is a common strategy in financial markets, but the GME saga put it under the microscope. Short interest in GameStop had reached extraordinary levels, sparking interest among retail traders who saw an opportunity for a “short squeeze.” Describe how the high short interest in GME made it an appealing target for WallStreetBets, and how short selling contributed to the explosive price changes.

- Yahoo Finance’s Real-Time CoverageYahoo Finance provided a real-time feed on GME’s price swings, commentary from analysts, and tools for tracking changes. The platform became an essential resource for both experienced and new traders seeking updates. Explain Yahoo Finance’s role in covering GME’s story, offering timely news updates and detailed stock analysis.

2. The Social Media and Meme Stock Revolution

- The Power of WallStreetBets and RedditWallStreetBets, a subreddit on Reddit, was one of the driving forces behind the GME stock’s yahoo finance gme meteoric rise. This section would analyze how online forums, where retail investors shared information and hyped up stocks, influenced markets. Discuss the rise of “meme stocks” and how the GME phenomenon reshaped retail investing culture.

- Yahoo Finance as a Trusted Source Amid Social Media ChaosWith social media amplifying the buzz, misinformation also spread. Yahoo Finance became a vital source of verified, up-to-date data on GameStop and other meme stocks. Highlight the role of established platforms like Yahoo Finance in providing reliable information amid a frenzy of often speculative social media posts.

- Analyzing the Meme Stock Trend and Market RisksThe meme stock phenomenon extended beyond GameStop to include stocks like AMC yahoo finance gme and Blackberry. Explain the risks involved in meme stock trading, especially for inexperienced investors attracted by hype. This section can also cover the regulatory response to meme stocks and how market bodies viewed the GME story.

3. How Yahoo Finance Influences Retail Trading Decisions

- Tools and Resources on Yahoo FinanceYahoo Finance offers a suite of tools that help investors analyze stocks, view charts, and make yahoo finance gme informed decisions. Discuss features like financial data, news updates, and community boards, which have all become crucial in the era of meme stocks and heightened retail trading.

- Expert Opinions and Analyst RatingsOne of Yahoo Finance’s strengths is its aggregation of expert opinions, analyst ratings, and news articles. For GME, this meant users had access to diverse perspectives—from financial analysts to independent bloggers. Describe how the mix of expert analysis and community discussions on Yahoo Finance helped investors make sense of GME’s fluctuations.

- Educational Content for New InvestorsMany new investors joined the trading world during the GME saga, some using Yahoo Finance as their main educational resource. This section could focus on how Yahoo Finance’s content has provided guidance yahoo finance gme for novice investors, offering articles on stock market basics, investment strategies, and risk management.

4. The Broader Implications of the GME Saga for Financial Markets

- Regulatory Changes and Increased ScrutinyThe GME incident prompted regulatory bodies like the SEC to evaluate trading practices and market stability. Detail how regulatory scrutiny increased, discussing potential changes in trading rules, the protection of retail investors, and the potential for future legislation aimed at meme stocks.

- Investor Sentiment and Market DynamicsGME’s rollercoaster showcased the power of collective investor sentiment and the influence of social media. Explain how investor sentiment, driven by online forums and financial news, created a yahoo finance gme “herd mentality” that drastically impacted market dynamics.

- Yahoo Finance’s Role in Democratizing Market InformationWith retail investors increasingly relying on digital finance platforms, Yahoo Finance played a part in democratizing access to financial information. This section can discuss how platforms like Yahoo Finance have empowered individual investors by providing accessible, real-time data and information on stocks like GME.

5. Lessons Learned from the GME Saga

- The Risks and Rewards of Retail TradingGME demonstrated both the thrilling rewards and potential pitfalls of retail trading. Provide insights on the importance of risk management, research, and patience in investing, especially for those yahoo finance gme entering the market based on trends and social media hype.

- Yahoo Finance as an Ongoing ResourceYahoo Finance’s extensive database, tools, and news feeds make it a valuable resource for those interested in retail trading. Highlight how investors can continue to use Yahoo Finance for reliable, comprehensive financial information even beyond meme stocks.

- What’s Next for Meme Stocks?Conclude by considering the future of meme stocks. Will another GameStop emerge? This section can speculate on the future of retail trading and meme stocks, drawing on Yahoo Finance’s ongoing role in reporting market trends.

Conclusion: Reflecting on GME’s Impact on Modern Trading

Reflect on how yahoo finance gme and the role of platforms like yahoo finance gme Yahoo Finance have reshaped the landscape of retail investing, pushing markets into uncharted territory and raising new questions about market regulation, the power of social media, and the democratization of financial information.